Residents of the District of Muskoka will face a 3.94% increase in the District portion of their municipal property taxes to fund municipal services and a 0.4% increase to support hospital redevelopment. This represents an annual impact of approximately $40.38 per $300,000 property assessment across the region.

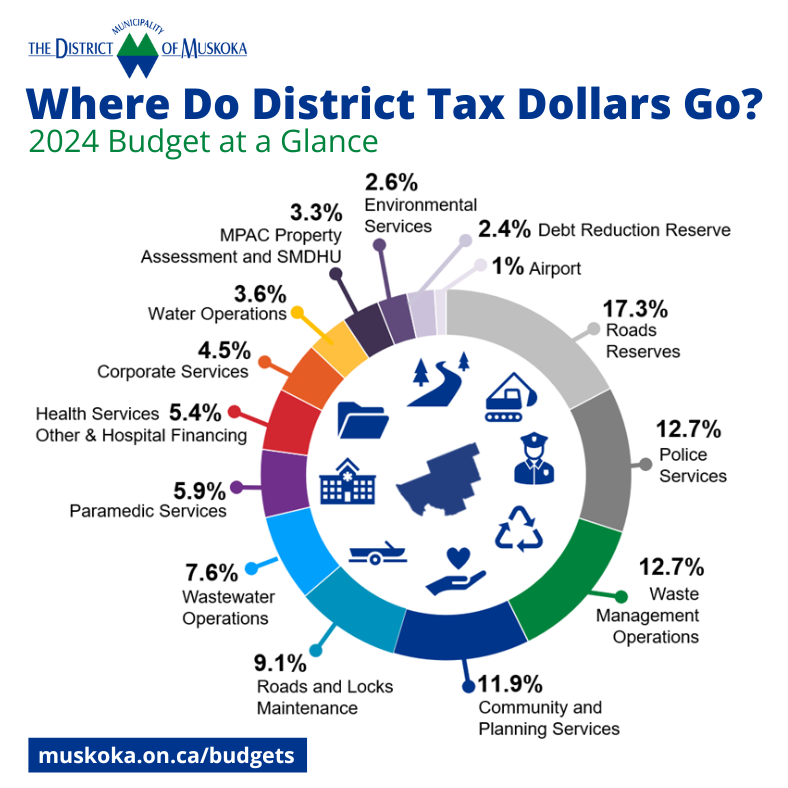

The District Council approved a $155.9M tax-support budget on December 18th to reflect an operating levy of $94.2M and $61.7M in capital. In a news release, the District Municipality of Muskoka says that it is experiencing pressures tied to inflation and the high costs of construction, supplies, and insurance. It adds that the budgeting process focused on achieving the best balance possible – investing in key services and infrastructure to keep pace and prepare for the future while exploring every opportunity to reduce costs and find efficiencies in service delivery.

District Chair Jeff Lehman says, “We understand the economic pressures facing Muskoka residents and businesses, and we have worked hard to limit the impact to taxpayers wherever possible. At the same time, we have a responsibility to maintain services for future community needs. Council and staff faced very challenging decisions together to achieve this budget of balanced priorities.”

Key investments include:

- $4.2Mto act on affordable housing and homelessness

- $23Mto improve Muskoka’s road network, including $11M for surfacing projects, $1.2M for low-volume road improvements, in addition to Gravenhurst (Bay St.), Bracebridge (Taylor Rd. Bridge), and Highway #118 projects.

- $30Mto expand access to 160 beds by redeveloping Fairvern Long-Term Care Home, part of a total investment of $ 121M

- $ 1.8M to support the future redevelopment of hospital sites in Muskoka and beyond.

- $35.8Mto fund future infrastructure needs by increasing our contributions to reserve funds

A rate-support budget for District water, sewer, and garbage services was approved by the District Council last month. These services are funded partly by user fees, which are determined by the service levels and vary across the District’s six area municipalities.

The district says they are working hard to maintain its strong financial position.

“We do this by participating in a joint investment board with other municipalities to increase our income, and by building up internal savings through District reserve funds,” says Suzanne Oliver, District Treasurer and Commissioner of Finance and Corporate Services. “These investments and savings allow the District to fund many projects without using more expensive external loans/debts.”

Learn more about the 2024 budget by visiting www.muskoka.on.ca/budgets